refund for unemployment taxes paid

Learn About The Common Reasons For A Tax Refund Delay And What To Do Next. California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee.

Is Unemployment Taxed H R Block

IRS Issues Refunds for Taxes Paid on Unemployment Compensation The IRS recently issued 430000 refunds totaling more than 510 million to taxpayers who paid taxes on.

. Pay the same UI taxes as those paid by commercial employers experience rating method. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. The first 10200 in benefit income is free of federal income tax per.

The IRS has sent 87 million unemployment compensation refunds so far. Each spouse is entitled to exclude up to 10200 of benefits from federal tax. If you have lost your payroll tax refund or if your payroll tax refund check is older than a year.

The American Rescue Plan Act of 2021 excluded up to 10200 in unemployment compensation per taxpayer from taxable income paid in 2020. For some there will be no change. The unemployment tax refund is only for those filing individually.

The Internal Revenue Service is delivering a fourth round of special tax refunds this week to 15 million taxpayers who paid taxes on unemployment benefits when they filed their. Congress made up to a 10200 in jobless benefits payment in 2020 tax-free for people earning less than 150000 a year. But that doesnt mean the couple as a tax unit always gets tax waived on double the amount.

People might get a refund if they filed their returns. Of that number approximately 4 million taxpayers are expected to receive a. Ad Learn How To Track Your Federal Tax Refund And Find The Status Of Your Direct Deposit.

After more than three months since the IRS last sent adjustments on 2020 tax returns the agency. For this round the IRS identified approximately 46 million taxpayers who may be due an adjustment. The exact refund amount will depend on the persons overall income jobless benefit income and tax bracket.

Ad Premium federal filing is 100 free with no upgrades for unemployment tax filing. If you received unemployment benefits last year you may be eligible for a refund from the IRS. For Wages Employers Paid in 2021.

The Internal Revenue Service this week sent 430000 tax refunds averaging about 1189 to filers who paid too much in taxes for their 2020 unemployment benefits. The IRS has promised to refund any taxes paid on the first 10200 of unemployment benefits earned last year but has said the money will go out this spring and.

When Will Irs Send Unemployment Tax Refunds 11alive Com

American Rescue Plan Act Of 2021 Nontaxable Unemployment Benefits Filing Refund Info Updated 5 13 21 Individuals

Too Much Money Irs Sending Refund To Those Who Overpaid

Transcript Help Am I Getting The Unemployment Refund What Does 291 Mean R Irs

Unemployment Tax Refund Could Put Thousands Back In Your Pocket

Because Of One Word Minnesota Can T Issue Refunds For Overpaid Unemployment Tax Minnesota Reformer

Taxpayers May Receive A Refund For Taxes Paid On 2020 Unemployment Compensation Tax Pro Center Intuit

Unemployment Tax Refund Taxpayers Frustrated By Irs Unresponsiveness

Irsnews On Twitter Irs Is Issuing Refunds For Taxes Paid On 2020 Unemployment Compensation Excluded From Income The First Adjustments Are For Single Taxpayers Who Had The Simplest Tax Returns Details At

Tax Refunds On Unemployment Benefits Still Delayed For Thousands

How Unemployment Stimulus Payments Will Affect Your Taxes Whas11 Com

/1099g-b89de84cce054844bd168c32209412a0.jpg)

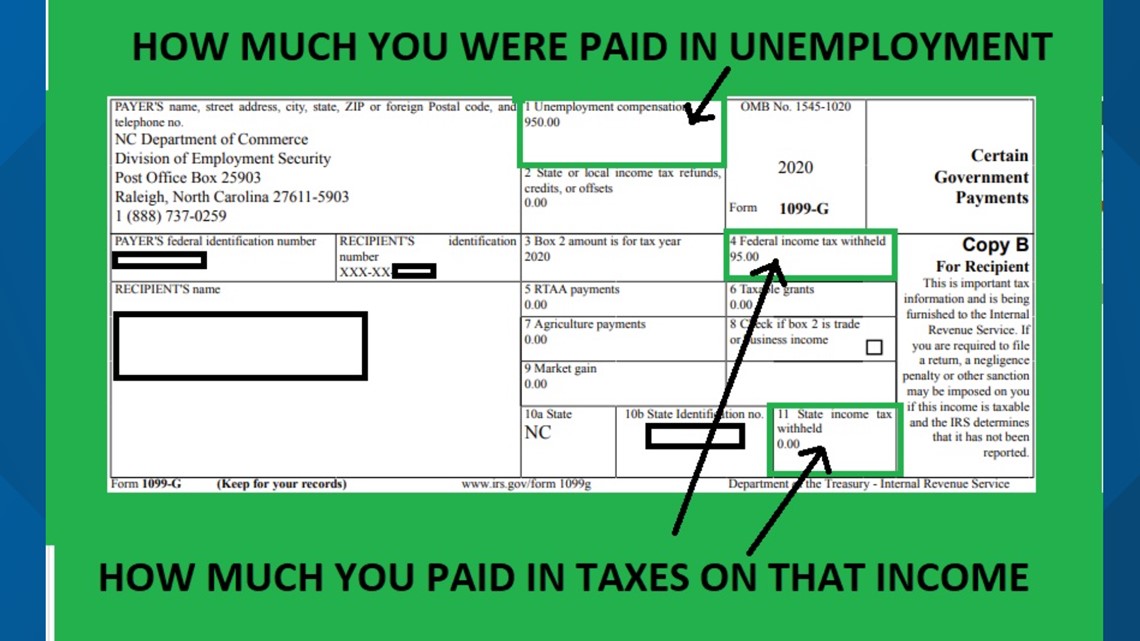

Form 1099 G Certain Government Payments Definition

Irs Starts Sending Unemployment Benefits Tax Refunds To Millions Of Taxpayers Plus More Special Refunds Payments On The Way

Unemployment Benefits Are Taxable Look For A 1099 G Form Wfmynews2 Com

If You Receive Unemployment Benefits Expect To Receive Form 1099 G Don T Mess With Taxes

Irs Sends 430 000 Additional Tax Refunds Over Unemployment Benefits

What The Irs Says About That Unemployment Stimulus Tax Break The San Diego Union Tribune

How To Claim An Unemployment Tax Refund And How To Check The Irs Payment Status As Usa